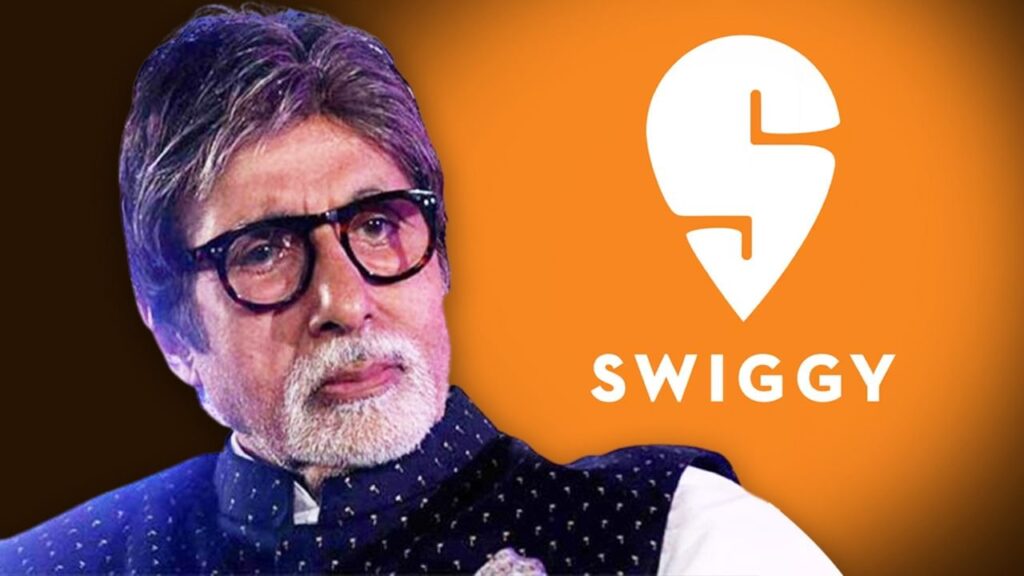

Recently, the online food delivery giant Swiggy has been in the spotlight, attracting significant attention from major celebrities and investors alike. Notably, the legendary Bollywood actor Amitabh Bachchan and prominent investor Ramdev Agrawal have made investments in Swiggy. This raises an interesting question: what has sparked such keen interest in the online food delivery sector among these industry giants? Let’s delve deeper into the factors behind this intrigue.

Swiggy’s Upcoming IPO and Its Implications

Swiggy is gearing up to launch its Initial Public Offering (IPO) with an ambitious target of raising approximately ₹10,400 crores (about $1.25 billion). Following the IPO, Swiggy’s market valuation is projected to soar to ₹1.25 lakh crores (approximately $15 billion). This potential valuation has enticed significant investors who are eager to capitalize on the company’s success and future growth.

Celebrity Investments: Who’s Involved?

Amitabh Bachchan’s family office has completed a deal to buy shares from Swiggy’s employees and early investors, signaling a strategic investment in the company. Concurrently, Ramdev Agrawal, who recently invested a staggering $66.5 million in the quick commerce platform Zepto, has also acquired a significant stake in Swiggy. These moves illustrate the confidence these prominent figures have in Swiggy’s growth prospects.

Understanding Swiggy’s Business Model

Swiggy stands as India’s largest food-tech company, aiming for a valuation of $15 billion through its upcoming IPO. According to media reports, Swiggy plans to raise $1 to $2 billion, making it the largest IPO in Indian history if successful. With backing from notable investors such as the Japanese titan Masayoshi Son of SoftBank, Swiggy is set to leverage its strong market position and the growing demand for online food delivery services.

Market Competition and Innovation

For several years, Swiggy has been in fierce competition with Zomato in the Indian food delivery market. As reported by Reuters, Swiggy has expanded its operations in recent years, venturing into grocery delivery through Swiggy Instamart and offering pick-and-drop services with Swiggy Genie. This diversification indicates a strategic approach to capture a larger market share amidst rising competition.

Future Plans and Growth Strategy

Swiggy’s forthcoming IPO is anticipated to be one of the most significant public offerings in the Indian tech landscape. The proceeds from the IPO are expected to be allocated to expanding services, enhancing technological infrastructure, and entering new markets. This strategic vision highlights Swiggy’s intent to solidify its leadership in the online food delivery space and beyond.

Table: Key Facts about Swiggy’s IPO

| Aspect | Details |

|---|---|

| Target Amount | ₹10,400 crores (~$1.25 billion) |

| Expected Valuation | ₹1.25 lakh crores (~$15 billion) |

| Major Investors | Amitabh Bachchan, Ramdev Agrawal, SoftBank |

| Main Services | Food delivery, grocery delivery, pick-and-drop services |

In conclusion, Swiggy’s plans for an IPO not only reflect the company’s successful trajectory but also signal a strong belief among key investors in the growth potential of the Indian food delivery market. By leveraging its market position and adapting to emerging consumer needs, Swiggy is poised to navigate its path toward a promising future.