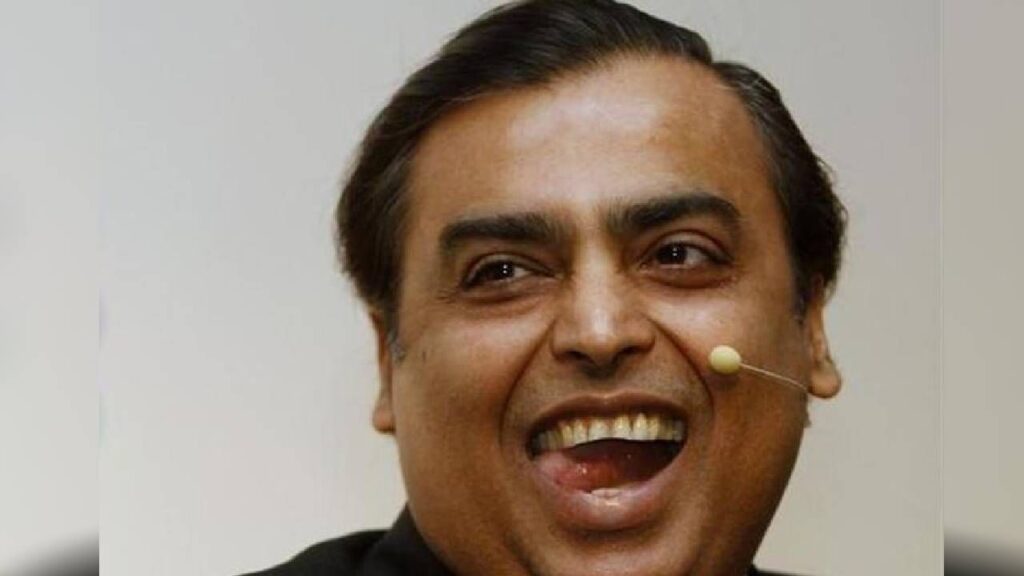

Before the AGM, Mukesh Ambani gave away ₹351 crores from Reliance.

Mukesh Ambani, the world’s renowned businessman and head of the highly valuable Reliance Industries, is set to hold the company’s Annual General Meeting (AGM) today. This meeting is pivotal as Ambani might offer significant gifts to the company’s 3.5 million shareholders. Prior to the AGM, he has already distributed a whopping ₹351 crores. These funds were allocated in the form of Employee Stock Ownership Plans (ESOPs) to 15 senior executives of Reliance Retail in the previous financial year, as disclosed in the documents submitted to the Registrar of Companies.

Details of the ESOP Distribution

According to reports, the company granted these top executives 4.417 million shares at a price of ₹796.5 per share, which is significantly higher than the nominal value of ₹10 per share. The AGM today will also focus on discussing the IPO (Initial Public Offering) of Reliance Retail, where it is anticipated that Ambani might announce the public listing of their retail and telecom businesses.

Expectations from the AGM

Even though Reliance has not made any official announcements regarding the IPO of its retail division, analysts believe that the company is likely to launch the IPO in the next two years. The discussions held today at the AGM will shed light on this matter and offer insights into the company’s future strategies. Prominent executives who received ESOPs include:

| Executive Name | Position |

|---|---|

| V. Subramaniam | Director |

| Damodar Mall | Chief Executive of Grocery Retail |

| Akhilesh Prasad | President and CEO of Fashion and Lifestyle |

| Kausal Nevarekar | President and CEO of Electronics Retail |

| Ashwin Khasgiwala | Chief Business Operations |

| Vineet Nair | CEO of Ajio |

| Kamdev Mohanty | COO of Grocery Retail and JioMart |

| Pratik Mathur | Head of Strategy and Projects |

| Vipin Tyagi | COO of Reliance Trends |

| Ketan Modi | COO of FMCG Business |

Financial Performance Overview

As of now, Reliance Retail has not responded to queries from the Economic Times regarding this distribution of ESOPs. Mohit Yadav, founder of the business intelligence firm Altinfo, pointed out that the allocation price of ₹796.50 per share reflects a staggering 7865% premium over the shares’ face value. Reliance Retail stands as the largest retail entity in India, with its revenue witnessing a remarkable growth of over 15% in the last financial year, summing up to ₹258,388 crores. Additionally, the company’s net profit soared by 26%, reaching ₹8,875 crores. Reliance Retail Ventures, which holds equity in Reliance Retail, infused ₹4,330 crores in equity and ₹14,839 crores in loans during the financial year 2024.