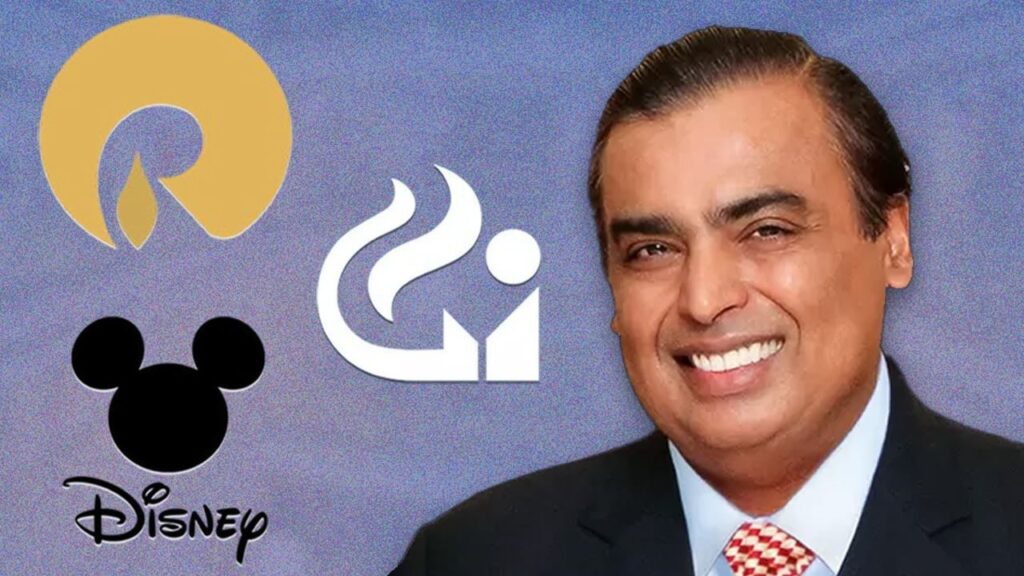

The landscape of television in India is on the brink of a significant transformation as Reliance Industries and Disney prepare for what is viewed as the largest deal in this sector’s history. Expected to be valued at around ₹71,000 crores, this deal is currently facing scrutiny and potential roadblocks from the Competition Commission of India (CCI), which has raised multiple objections. To address the CCI’s concerns and expedite the completion of this deal, Mukesh Ambani and Disney executives may take substantial steps forward.

Understanding the Reliance-Disney Deal

The deal involves Reliance acquiring operations from Star India, which has entered its final stages and is anticipated to conclude by October. The CCI is concerned that this merger could lead to monopoly practices in the market, especially regarding cricket broadcasting rights and advertisement rates. Therefore, the commission has posed several serious questions to both companies regarding the implications of this merger.

Potential Proposals to Address CCI Concerns

To alleviate the concerns raised by the CCI, both Reliance and Disney are reportedly preparing some significant proposals. According to sources familiar with the matter, they may offer to freeze advertisement rates for a period of two years post-merger. This means that the current advertisement rates for channels under the merged entity will remain unchanged for the next couple of years, allowing the companies to reassess rates after that period.

Concerns from the CCI

The CCI has been entrusted with the task of maintaining competition within the economy. Currently, Reliance holds ownership of Viacom18, which operates the Jio Cinema OTT platform, while Disney manages the operations of Star India, including its flagship OTT service, Disney+ Hotstar. Together, these entities dominate the broadcast rights for IPL and ICC cricket matches in the country, which is a significant concern for the CCI.

Impacts on Other Market Players

Sources indicate that the CCI has reached out to Disney separately to express its apprehensions regarding the merger. The commission suggests that this consolidation might have repercussions for other players in the market, including Sony, Zee Entertainment, Netflix, and Amazon Prime Video. Post-merger, the new entity would control an extensive portfolio, encompassing around 120 television channels and two major OTT platforms.

Conclusion

The coming months will be crucial as Reliance and Disney strive to navigate the regulatory waters surrounding this monumental deal. With proposals aimed at addressing competition concerns, stakeholders in the media and entertainment industry will be watching closely to see how this merger could reshape the landscape of TV broadcasting and streaming in India.