Introduction

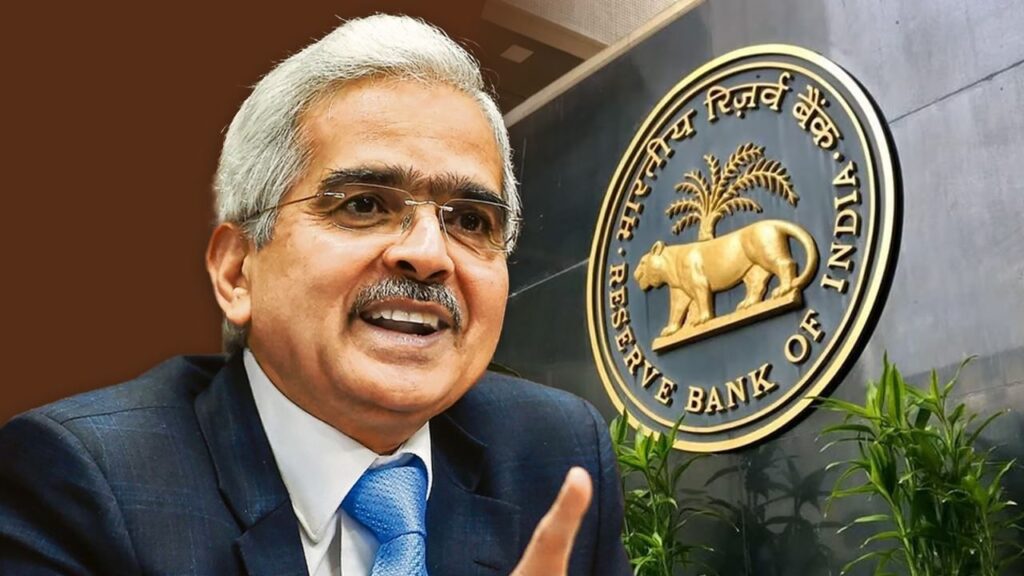

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, recently highlighted the ongoing efforts to elevate the Unified Payments Interface (UPI) and RuPay to truly global standards. Addressing the Global Fintech Fest 2024, Das emphasized the importance of financial inclusion, digital public infrastructure (DPI), consumer safety, cybersecurity, sustainable finance, and the global integration of financial services as key pillars of the RBI’s strategic focus.

Key Highlights from the Governor’s Address

In his address, Governor Das stated, “India is actively participating in international forums and bilateral agreements to promote economic cooperation with various countries.” He underscored the RBI’s strong commitment to strengthening financial infrastructure, including cross-border payment systems, which is a priority area for the bank. He also emphasized that the focus is shifting towards making UPI and RuPay genuinely global.

Progress with International Networks

Governor Das noted significant advancements in the direction of integrating the UPI network with RuPay cards and payment acceptance in several countries, including Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, France, and others. These collaborative efforts serve to underscore the global adoption of India’s financial initiatives.

UPI and RuPay: An Overview

UPI, or Unified Payments Interface, enables seamless inter-bank transactions via mobile phones, while RuPay is a domestically developed card payment network with global reach. Das emphasized that India possesses the necessary technological capabilities and a robust fintech ecosystem to become a global hub for digital innovation and fintech startups. The country seeks to forge and strengthen strategic partnerships and enhance commitments to international cooperation.

Investment and Economic Growth

In the past two years, the fintech sector in India has attracted nearly $6 billion in investments, reflecting the growing global interest in Indian financial technology. Governor Das stated that India is now a rapidly expanding economic power and urged financial institutions and fintech entities to adopt a robust framework to seize emerging opportunities while mitigating risks. He highlighted the unique advantages of digital financial inclusion, which can deliver scalable and cost-effective solutions.

The JAM-UPI-ULI Triad

Das introduced the concept of the JAM-UPI-ULI triad as a revolutionary step in India’s digital infrastructure journey. This trio aims to leverage the advantages of Jan Dhan accounts, Aadhaar, and mobile technology to enhance financial inclusion and streamline payment processes across the country.

Conclusion

In summary, the initiatives laid out by Governor Shaktikanta Das highlight India’s commitment to becoming a leader in the global fintech landscape through the UPI and RuPay systems. By fostering international cooperation and innovation, India stands poised to capitalize on its growing economic potential in the digital finance space. As these systems expand globally, they promise to redefine financial transactions and accessibility worldwide.