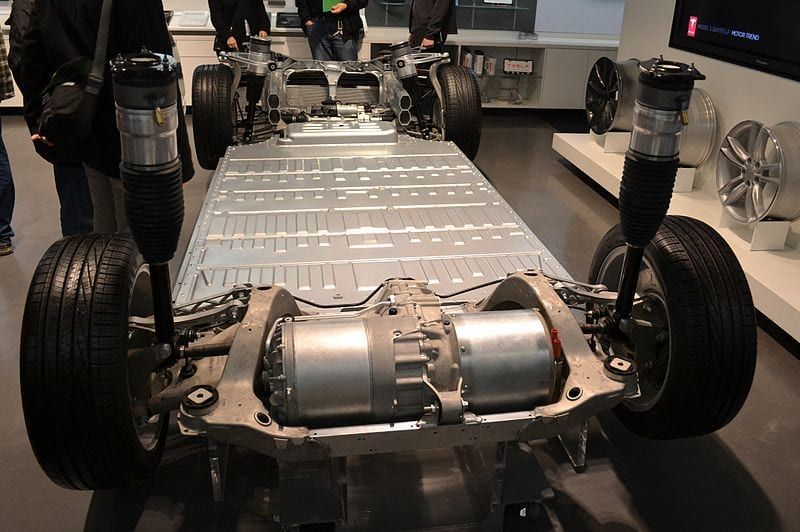

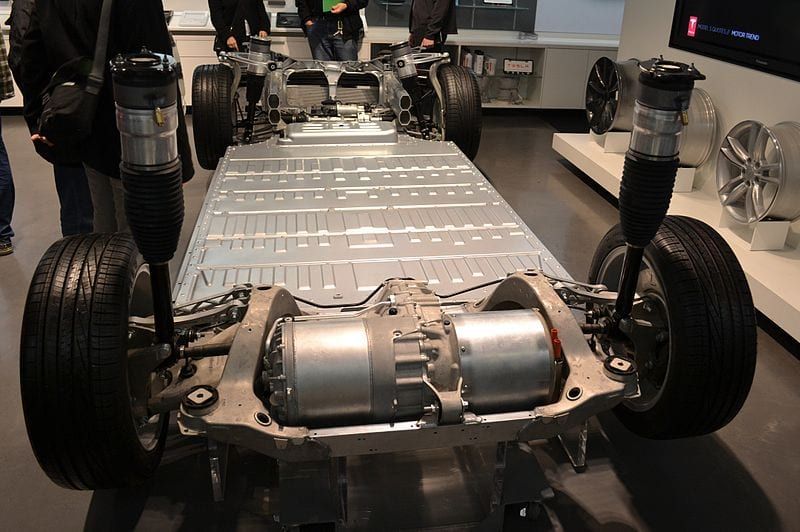

The battery foundation of a Tesla Product S. Oleg Alexandrov / CC BY-SA/ Wikimedia Widespread

If there is one (non-on-line retailer) enterprise that prospered in 2020 regardless of the chaos, it’s electric powered auto startups. (Irrespective of whether they’ve experienced a viable item or not has been beside the level.) QuantumScape, a Invoice Gates-backed startup building the upcoming-technology batteries for EVs, is arguably at the centre of this electrical buzz.

In November, QuantumScape went community by a reverse merger with Kensington Capital’s specific acquisition unit at a valuation of $3.3 billion. Since then, its share price has soared as a result of the roof, jumping from $10 on market debut to more than $95 at Monday’s near.

“This valuation is absurd and unjustified,†explained Ian Bezek, a previous hedge fund analyst who now writes for Investor Place.Â

What lured buyers into piling in on the younger company’s inventory is its daring target to commercialize sound-point out batteries, an emerging lithium-ion battery alternate that bears the guarantee to significantly lower the charge of electric powered automobiles.

Sound-condition batteries are fewer flammable, cost more quickly and have a better electrical power density (therefore for a longer period driving variety) than lithium-ion batteries. The only draw back is that, with present technological know-how, they are high-priced to make.

See Also: Can Elon Musk Supply On Tesla’s Big Battery Guarantee? EV Insiders Weigh In.

QuantumScape touts a lithium-steel battery technologies that could change all that. The company mentioned its prototype single-layer pouch cell has demonstrated the skill to recharge batteries up to 80 p.c ability in 15 minutes and enable a automobile to last hundreds of 1000’s of miles even in severe temperatures (as reduced as -22 levels Fahrenheit).

Through a online video presentation earlier this month, QuantumScape scored a main endorsement from Nobel Prize-profitable chemist Stanley Whittingham, who said the startup’s lithium-metallic technological innovation could raise battery electricity density by 50 %, if not 100 %.

And Bill Gates, who’s not a chemist by any implies but, according to QuantumScape CEO Jagdeep Singh, has apparently come to be an skilled given that investing in the organization, is also completely at the rear of the strategy.

“I didn’t actually assume he understood anything at all about chemistry, and we are all about chemistry. But when he thinks a little something is significant he can dive genuinely deep and develop into an professional in that location. He has gotten pretty deep into this space,†Singh explained to Fortune not too long ago.

Nonetheless, nothing is penned in stone just nonetheless, at the very least on the monetary aspect. According to its individual solution roadmap, QuantumScape will be tests batteries through 2023. If profitable, a factory will be crafted in 2024, and it hopes constant revenues will move in two yrs after that. But investors shouldn’t assume profitability until finally at the very least 2027.

“Long story brief, you are heading to want to be individual for the improved aspect of the upcoming ten years right before QuantumScape starts producing critical dollars,†wrote Investor Area‘s Bezek. “Make no slip-up, QuantumScape is a worthwhile strategy. Nonetheless, its existing valuation is utterly ridiculous. There is only no way to make the math perform.â€

QuantumScape is backed by Monthly bill Gates’ Breakthrough Energy Ventures, Volkswagen, Qatar’s sovereign wealth fund, Stanford College, German automobile supplier Continental and a roster of Silicon Valley VC firms.