Netflix is eyeing what it would look like to be a lot more like 1 of its top rated competitors: The Walt Disney Business. Picture-illustration: Observer (from Matt Stroshane/Walt Disney Globe Vacation resort by using Getty Photos)

At situations, the leisure business can sense as if it is trapped in a cyclical vortex of imitation and duplication. The back-and-forth dance of offensive strike and counter offensive get started to resemble a mimicry fairly than a fight. Take Netflix and Disney.

The former charted a long term class for the overall entertainment market by spearheading Hollywood’s transition into direct-to-consumer enterprise and revealing the generously prolonged leash Wall Road rewards to these streaming endeavors. Disney, a multi-faceted conglomerate with brick-and-mortar operations as well as an expansive theatrical and media community enterprise, realizes it demands to do the exact and strips all of its written content from Netflix in advance of launching its individual provider. Netflix builds its empire on the premise of delivering anything for everyone Disney+ thrives since of its concentrated core of particularly tailor-made mental residence.

Now, we have arrived at however yet another revolution in the vortex that looks to reverse the direction of the spin. Netflix really nicely may well now be making an attempt to become a Disney doppelganger.

Netflix’s Catalysts for Change

The “pull ahead impact†of the publish-COVID sector has accelerated Netflix’s aggressive landscape as customers are flush with far more streaming freedom and flexibility than at any time right before or ever again. Disney+ is delivering blockbuster weekly reveals that dominate the zeitgeist. HBO Max is providing tentpole capabilities like Surprise Lady 1984 and Godzilla vs. Kong. Amazon is getting significantly much more selective and the technique, from The Boys to Borat Subsequent Moviefilm and Coming 2 America, appears to be spending off.

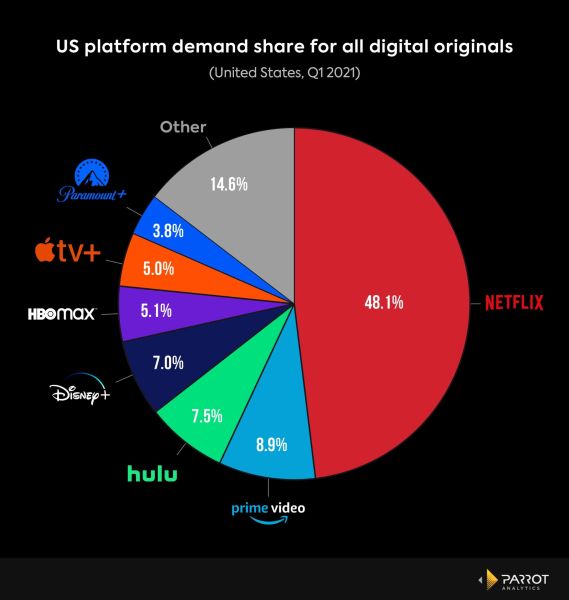

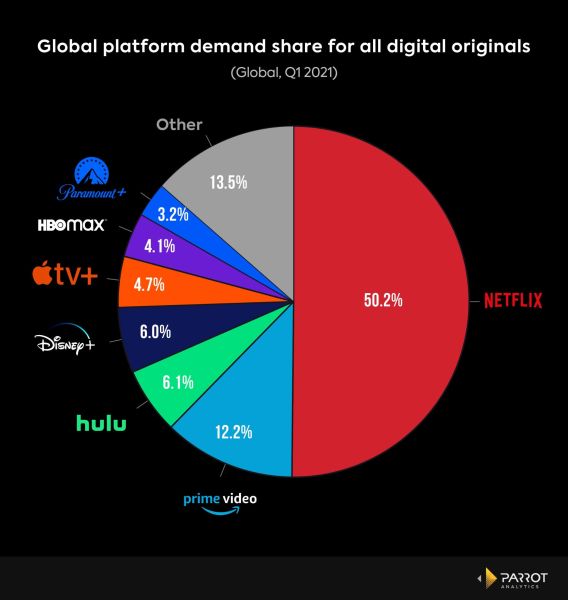

Netflix is nonetheless the dominant participant in the around the world streaming sport, but its world-wide and U.S. electronic first demand from customers share has shrunk to file lows in 2021 because of to mounting levels of competition, in accordance to Parrot Analytics.

Parrot Analytics Parrot Analytics

Parrot Analytics Parrot Analytics

Netflix reported in January it no longer desired to borrow revenue to fund information expenses though also shelling out off its $16 billion in debt. Nonetheless with improved competition, one would assume the business may well have to retain upping its information spending budget to maintain its shrinking lead. With a shrinking library as a final result of increased competition, 1 may assume they would have to have to expend far more to manage scale. And with a declining batting normal when it arrives to strike originals, a person would believe they could possibly want to spend a lot more to deliver prolonged-tail successes.

As a end result, Andrew Rosen—former Viacom digital media exec and founder of streaming newsletter PARQOR—believes Netflix may choose to shift absent from its 1-cease-shop buffet style offerings and adopt a extra selective tactic akin to Disney.

Netflix is “betting massive on anime, they’re betting significant on Hollywood blockbuster style motion pictures, and they’re betting massive on international shows.†–Andrew Rosen

Turning out to be Disney

In September, Netflix co-CEO Reed Hastings advised the New York Instances that two of the greatest authors in the enjoyment sector were being Neal Gabler, who wrote the definitive biography of Walt Disney, and Bob Iger, who pretty much ran Disney. In February, Hastings instructed traders that Netflix’s long-term aim is to defeat Disney at animation: “We’re really fired up about catching them in spouse and children animation, probably eventually passing them, we’ll see. A lengthy way to go just to capture them.â€

Netflix “becomes†Disney by refocusing its material efforts on essential verticals that sharpens the effectiveness of investment decision. There’s a reason why Netflix’s content material spending budget devoted to initiatives in advancement is just about triple that of Disney’s. There is also a rationale why their return-on-financial commitment isn’t as outstanding. So what does a fewer unwieldy Netflix even look like?

“They’re betting significant on anime, they are betting massive on Hollywood blockbuster type motion pictures, and they are betting huge on international demonstrates,†Andrew Rosen said. These are a few refined verticals that could occur to compose the basis of the streamer’s transition and future.

“I’m surprised that Extraction was watched by 99 million member homes globally,†Rosen stated. “I’m even now surprised that Lupin, a French demonstrate was #1 in Brazil just after release. It tells you that they can obtain gems, price tag-successfully, which their subscribers will take in all over the world. That’s a incredibly various story from ‘Debtflix’ and it is a approach on which Head of World-wide Tv set Bela Bajaria designed her track record in just Netflix.â€

Whilst this strategy can assist cut down over-all articles costs and greater concentrate Netflix’s endeavours, accomplishment continues to be elusive…at least publicly. Rosen details out that we generally see Netflix make investments in huge titles, but we master little about how they execute. About the Moon was promised to buyers as 1 of these Disney-variety bets, obtained sizeable promotion from the firm, and eared two Oscars nominations. However we’ve listened to almost nothing but silence from Netflix about its effectiveness. The similar goes for fellow animated titles Klaus, The Dragon Prince or She-Ra. Cocomelon and Jurassic Environment: Camp Cretaceous have done perfectly in Nielsen ratings and Netflix’s Best 10 tracker, yet are certified properties.

“I’m obviously painting broad brushstrokes here, but the issue is, as a great deal as Netflix talks about Disney and animation as organization targets, it is harder to discern wherever the wins have been for them,†Rosen explained.

Justifying upcoming strategy

Disney can lock you into its ecosystem with confirmed IP as you jump from major branded franchise to major branded franchise. Netflix should retain users inside its possess system mostly by original material that doesn’t gain from decades of blockbuster box workplace accomplishment. It is an additional obstacle in Netflix’s quest to become Disney.

“Netflix desires to carry on to justify cost improves,†Rosen explained. “That usually means it wants to establish demand is inelastic and churn is minimum.â€

Area-language content helps on this front as it satiates regional audiences but can also travel perfectly by means of dubbing and translation, this kind of as Lupin. Anime is another category that does so, as evidenced by the achievement of Castlevania, Netflix’s ballooning anime library and rival companies like Crunchyroll. And at last, Hollywood blockbuster movies aid on this front, for every Rosen, turning into can’t miss tentpole events. There is a reason why the streamer swooped in to devote $200 million-plus on Dwayne Johnson’s Purple Detect, $469 million on Rian Johnson’s Knives Out sequels, and is franchising the hell out of Zack Snyder’s Army of the Useless.

Netflix may perhaps want to be Disney, but it desires to do so by finding its personal main verticals to spend in, and not necessarily turning out to be a spouse and children-pleasant rival to the Mouse Property. For now, that usually means focusing on animation, nearby-language programming, and blockbusters. We’ll see if other genres come at the cost of that focus as the field moves as a result of the streaming war battles.

Movie Math is an armchair assessment of Hollywood’s strategies for large new releases.