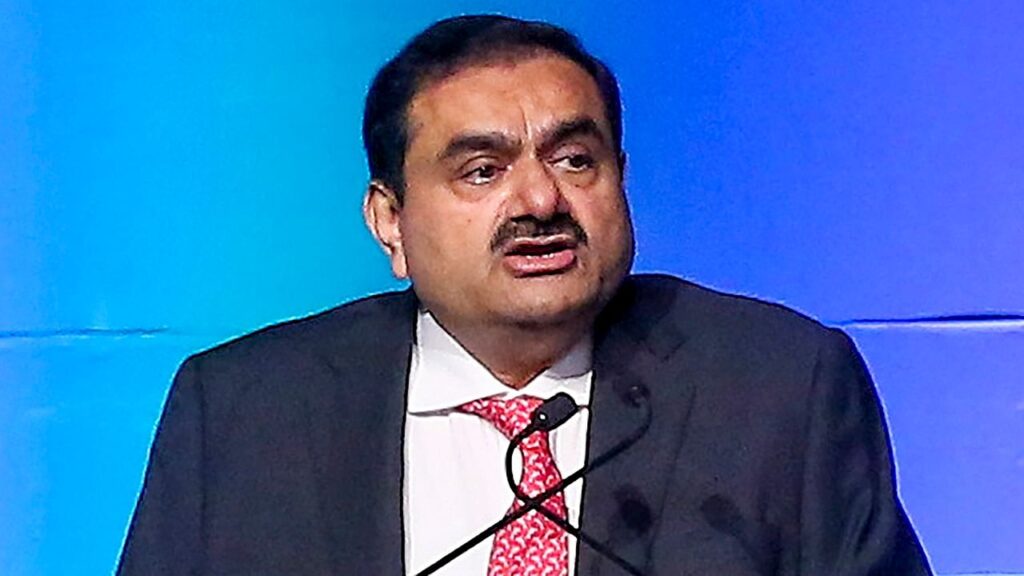

Recently, industrialist Gautam Adani has once again become a focal point in the business world, particularly within the renewable energy sector. Despite facing turbulent times over the past two years, including significant challenges and scrutiny from short-sellers, it appears that Adani’s business ventures are weathering the storm and thriving. The Adani Group has reported impressive financial results that highlight continued growth and resilience in key sectors such as solar energy, wind energy, and airport operations.

Remarkable Financial Growth

In its first quarter of the fiscal year 2024-25 (April-June), the Adani Group reported a staggering 33% increase in revenue, amounting to ₹22,570 crore. This exceptional growth can be attributed to the solid performance of its core infrastructure business alongside robust results from its renewable energy and airport operations.

Substantial Increase in Profit

The net profit for the Adani Group in this quarter has also seen an impressive surge of over 50%, reaching ₹10,279 crore. The group attributes this growth to its ongoing increase in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which serves as an indicator of its operational stability. Importantly, the group’s infrastructure fundamentals remain strong, which supports its overall financial health.

Resilience Amidst Challenges

This remarkable performance holds even greater significance as it follows a tumultuous period for the Adani Group, which faced two major attacks from the American short-selling firm Hindenburg Research in the past 1.5 years. The report released in January last year had a devastating impact on the company, leading to a substantial drop in share values, and consequently, Gautam Adani’s net worth was nearly cut in half. However, the latest financial results indicate that the group is on a recovery path, with strong operational metrics backing its comeback.

Key Strengths of Adani Group

The strength of the Adani Group’s core infrastructure lies primarily in its subsidiaries, including Adani Green Energy, Adani Power, Adani Energy Solutions, and Adani Ports and SEZ. Each of these companies has contributed to the overall growth of the group.

Flagship Companies Showing Strong Results

| Company Name | Tax Before Income (₹ Crore) | Net Profit (₹ Crore) | Percentage Growth |

|---|---|---|---|

| Adani Enterprises | 4,487 | 1,776 | 46% and over 100% |

| Adani Green Energy | 2,866 | 629 | 30% and almost 100% |

| Adani Power | 3,490 | — | 54% |

| Adani Ports & SEZ | 3,107 | — | 47% |

| Adani Total Gas | — | 172 | 14.4% |

Emerging Infrastructure Companies

Under Adani Enterprises, a range of emerging infrastructure companies is making significant strides. These include Adani New Industries Limited, which focuses on airports and road construction. These emerging companies have reported impressive growth figures, with an overall growth rate exceeding 70%, leading to a profit of ₹2,991 crore.

Your Takeaways

The Adani Group’s robust financial performance signals its ability to overcome challenges and capitalize on growth opportunities in the renewable energy sector and beyond. As the group continues to cement its presence in critical industries, it paves the way for a more sustainable and profitable future.