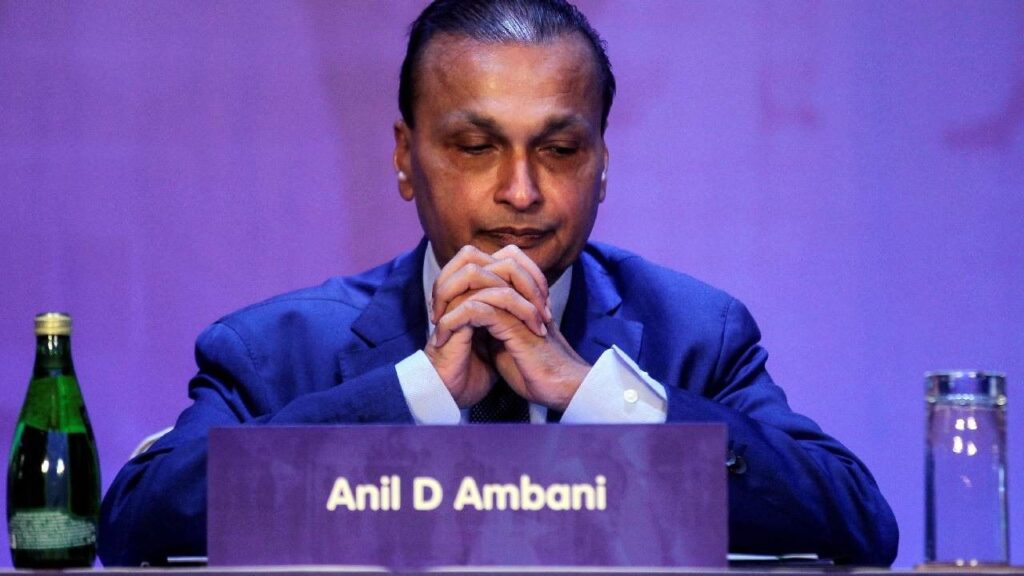

In a shocking turn of events, prominent industrialist Anil Ambani has faced significant repercussions from the Securities and Exchange Board of India (SEBI). The market regulator has imposed a ban on Ambani for five years, alongside a hefty penalty of Rs 25 crores. This decision affects Ambani as well as 24 other entities, barring them from participating in the securities market due to allegations of fund diversion.

Overview of the Ban

SEBI’s ruling prohibits Anil Ambani from engaging in any capacity with listed companies or registered intermediaries as a director or key managerial personnel during the ban period. This decisive action underscores the severity of the allegations against him and highlights the regulatory framework’s commitment to maintaining market integrity.

Why was the Ban Imposed?

The primary reason for the ban stems from accusations of misappropriation and diversion of funds at Reliance Home Finance (RHF). According to SEBI, Anil Ambani orchestrated a fraudulent scheme with the assistance of key managerial personnel, concealing the withdrawal of funds from RHF as loans to associated entities. Despite stringent directives from RHF’s Board of Directors to curb such practices, the management allegedly overlooked these orders, indicating a significant failure in governance directly influenced by Ambani.

Impact on Reliance Power Shares

The announcement from SEBI had an immediate adverse effect on the stock market, particularly for Reliance Power. Following the news, shares plummeted by over 5% during trading hours, marking a sharp decline after a period of notable price surges. Investors reacted swiftly to the developments, leading to significant trading volume and heightened volatility in the stock.

Penalties on Reliance Home Finance

In addition to Ambani’s personal ban, SEBI imposed a fine of Rs 6 lakhs on Reliance Home Finance for its role in the controversy, and the company itself has been banned from the market for a duration of six months. This further demonstrates SEBI’s firm stance against regulatory violations and its efforts to enforce compliance among financial institutions.

Table of Key Facts

| Fact | Details |

|---|---|

| Ban Duration | 5 years |

| Penalty Amount on Anil Ambani | Rs 25 crores |

| Additional Penalty on RHF | Rs 6 lakhs |

| RHF Ban Duration | 6 months |

| Impact on Reliance Power Shares | -5% drop immediately post-announcement |

Conclusion

The recent actions taken by SEBI against Anil Ambani and his associated entities highlight the ongoing scrutiny faced by corporate leaders in the financial sector. The regulatory body’s commitment to uphold ethical practices is critical for investor confidence and market stability. As the situation unfolds, the repercussions of this ban will likely resonate throughout the industry, serving as a stern warning to other market participants about the importance of regulatory compliance.