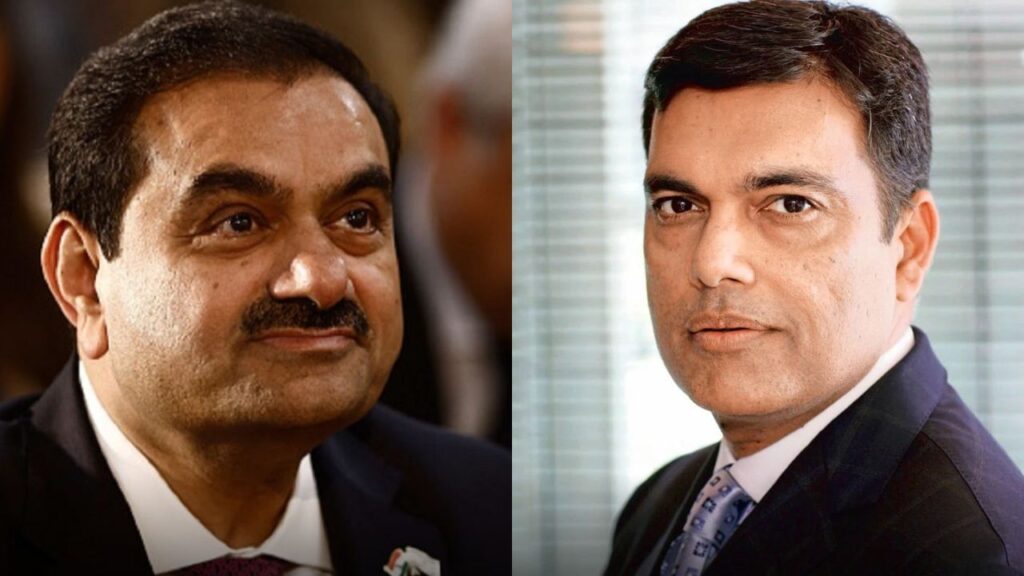

In recent years, there has been a significant push for green energy alternatives in India to reduce carbon emissions. While the Adani Group has held a dominant position in the solar and wind energy sectors, the JSW Group appears to be preparing to pose a formidable challenge in the near future. Recently, JSW Energy secured a major contract in Maharashtra, marking a significant step in the competitive landscape of renewable energy.

New Renewable Energy Project in Maharashtra

JSW Neo Energy, a branch of JSW Energy, announced on Tuesday that it has successfully obtained a green energy project from the Maharashtra State Electricity Distribution Company Limited (MSEDCL). This project will involve a combination of wind and solar energy, allowing the company to expand its renewable footprint in the region.

Capacity and Future Goals

This project is expected to generate an impressive 200 megawatts of power. The contract was awarded based on competitive tariff bids, highlighting the company’s commitment to cost-effective and sustainable energy solutions. With this ‘Letter of Award’, JSW Energy’s total installed capacity will increase to 17.2 gigawatts, which includes a hybrid capacity of 2.9 gigawatts. The company has set an ambitious target to establish an installed capacity of 10 gigawatts by the fiscal year 2024-25, up from its current capacity of 7.5 gigawatts.

Long-Term Vision

Looking further ahead, JSW Energy plans to ramp up its production capacity to 20 gigawatts by the year 2030 and aims to develop a storage capacity of 40 gigawatts per hour. Additionally, the company has set a goal to achieve carbon neutrality by 2050, aligning with global sustainability trends. Just days prior to this new order, JSW Energy also secured a 300 megawatt wind-solar hybrid project from NTPC, demonstrating its forward momentum in the renewable sector.

Recent Developments in Karnataka

In another strategic move, JSW Renewable Energy Twenty Limited, a subsidiary of JSW Energy, signed a power purchase agreement with the Bangalore Electricity Supply Company for a 300 megawatt project gained from the Karnataka Renewable Energy Development. This agreement showcases JSW’s commitment to expanding its renewable portfolio in various regions across India.

Competitive Landscape in the Cement Sector

The competition between the Adani Group and the JSW Group is not limited to renewable energy; it has also extended into the cement sector. Adani Cement (comprising ACC and Ambuja) is actively acquiring several smaller cement companies to expand its market share. Recently, they were in a bidding war with the JSW Group for the acquisition of Orient Cement Limited, owned by the C.K. Birla Group. Similar scenarios unfolded in 2022, where all three groups competed to take over Holcim’s Indian business, indicating a highly competitive environment across various sectors.

Table of Key Highlights

| Category | JSW Energy | Adani Group |

|---|---|---|

| Current Installed Capacity (GW) | 7.5 | Not disclosed |

| Target Capacity by 2024-25 (GW) | 10 | Not disclosed |

| Long-term Goal (2030) | 20 GW | Not disclosed |

| Carbon Neutrality Target Year | 2050 | Not disclosed |

As the competition escalates between these two influential players, the renewable energy landscape in India is poised for transformative growth. Both companies are aligning their strategies to meet the increasing demand for sustainable energy solutions, ultimately benefiting the environment and advancing India’s green energy agenda.