How WarnerMedia-Discovery will much versus Netflix, Amazon and Disney. AT&T, WarnerMedia, Discovery

On Monday, AT&T’s WarnerMedia and Discovery Inc. introduced their intentions to merge into one new mega-media conglomerate. At the time, we reviewed the key offer details and the deluge of questions that accompanied the shocking position-quo disruption. We’ve also explored how the combined organization can and most likely will hit the floor operating, but may possibly facial area hurdles in extensive-time period streaming warfare. These days, let us dive into how the merger’s greatest strength—the complementary mother nature of every single company’s unique programming—may also show to sooner or later be problematic in the long term.

How WarnerMedia and Discovery programming matches collectively

Diesel Labs, a predictive material analytics platform that pulls details on audience engagement and fascination throughout the leisure spectrum, uncovered that WarnerMedia and Discovery’s written content catalogs pair nicely with a single a further. Clearly, this was an important position of curiosity to equally AT&T CEO John Stankey and Discovery Inc. CEO David Zaslav.

“WarnerMedia content outperforms in phrases engagement, possessing 8.7% of all new titles (shows and motion pictures) coming out this year and producing a substantial 20.2% share of engagement,†Anjali Midha, co-founder and CEO of Diesel Labs, informed Observer. “Discovery outperforms in conditions of quantity, proudly owning a extraordinary 17.2% of all new titles this year (many thanks in component to the launch of Discovery+ before this yr), but producing just below 1% of all engagement.â€

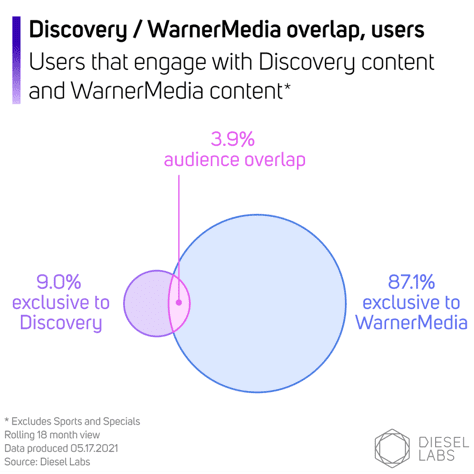

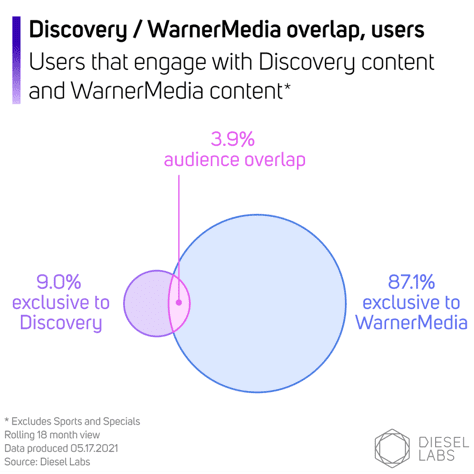

“The WarnerMedia and Discovery audiences only overlap modestly with 3.9% of individuals engaging with content from each providers.â€

All around 60% of Discovery’s catalog unveiled around the past a few-to-5 many years is way of life and fact material while these genres make up just 3% of the WarnerMedia catalog. The previous is an spot other major streamers have been seeking to incorporate in their own SVOD pushes as lower-price tag but substantial-upside genres. Paired with WarnerMedia’s track history of premiere programming and blockbuster movies and the coupling makes an huge volume of strategic perception.

Alongside one another, WarnerMedia and Discovery have 26% of all new titles (across reveals and videos) in 2021—overtaking the former chief Netflix who owns 24% of all new titles, Midha points out. WarnerMedia is also powering 3 of the major 10 most anticipated titles coming out this yr, in accordance to Diesel Labs facts (SpaceJam: A New Legacy, The Suicide Squad, and In the Heights)—leading the pack and even beating out Disney with only two of their titles in the top rated 10 (Black Widow, Loki).

Both equally companies will be equipped to increase their sphere of influence with the support of the other as the two catalogs also provide together diverse viewers profiles. For every Diesel Labs, WarnerMedia engagers skew Male (56%) and more youthful (40% of the engaged viewers is under 25 decades outdated) when Discovery skews Woman (55%) with much less engagers beneath 25 (20%). In the platform’s projections, the blended enterprise now ranks fourth in engagement across content catalogs among the big media firms behind Disney, NBCUniversal and Netflix. Other folks would argue the new organization has leapfrogged NBCU.

Why this may possibly actually be a problem

The inverse of this demographic expansion is the lack of viewers who desire equally, which could determine how the new business deals Discovery+ and HBO Max. One purpose that The Walt Disney Corporation has been so unprecedentedly successful with its streaming bundle—which brings together Disney+, Hulu, and ESPN+ for $13.99 for each month—is the crossover appeal amongst all 3 companies. WarnerMedia-Discovery doesn’t show up to boast the exact 360 enchantment.

Discovery/WarnerMedia overlap consumers. Diesel Labs

“The WarnerMedia and Discovery audiences only overlap modestly with 3.9% of men and women engaging with content material from the two organizations,†Midha claimed. “This poses an appealing problem to the joint company as it considers its immediate-to-client distribution channels—in all likelihood there will be a ongoing need to have for Discovery+ (or the way of life information catalog) at a reduce cost position than HBO Max. Further, it’s unclear if there is a sturdy sufficient viewers who would be fascinated in obtaining entry to the complete ‘bundled’ catalog, primarily if it is a lot more highly-priced than HBO Max nowadays.â€

Regardless of the accomplishment of the Disney bundle, Hulu is envisioned to at some point be folded into Disney+ at some place in the long term immediately after Disney retooled its streaming strategy. If it may not be sustainable prolonged-expression for the speediest-rising streaming superpower in the globe, than WarnerMedia-Discovery may possibly be faced with some hard possibilities forward.

The two bundling HBO Max and Discovery+ as different entities and integrating them into just one supersized company occur with pros and negatives. It is up to the newly formed govt leadership to make your mind up on the optimal path forward.