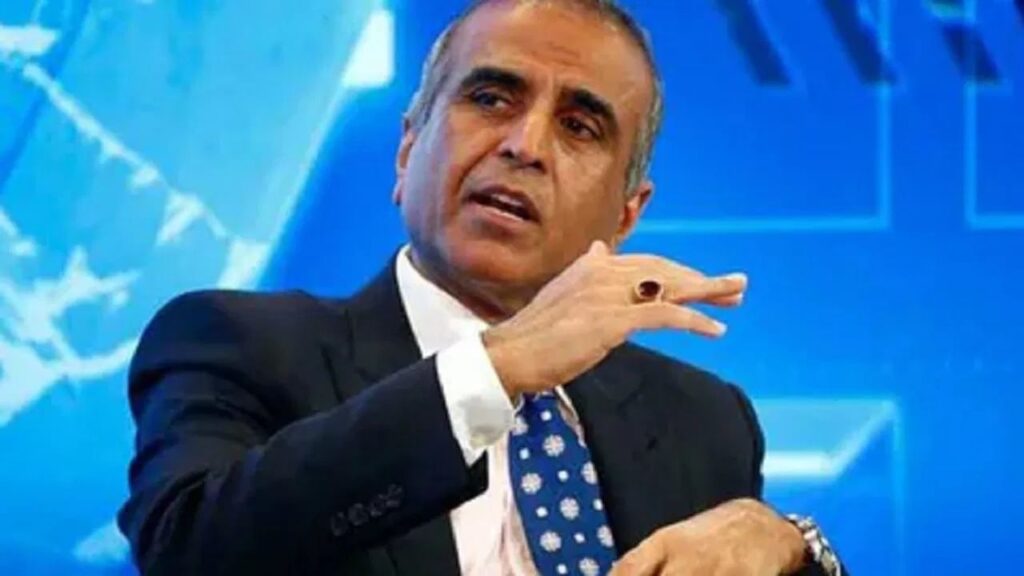

One of India’s leading telecom companies, Airtel, led by Sunil Bharti Mittal, is set to discontinue one of its business ventures. Yes, you heard it right. Reports indicate that Bharti Airtel plans to exit the music segment and will be shutting down its Wink Music app. According to the information provided, the company intends to accommodate all employees of Wink Music elsewhere within the organization. Interestingly, Airtel’s shares witnessed a slight increase, closing at ₹1,522.50. Let’s delve deeper into this development based on various sources.

Airtel Confirms the Decision

Airtel has confirmed through a spokesperson that the company is planning to shut down Wink Music in the upcoming months. The spokesperson emphasized that all employees of Wink Music will be integrated into the Airtel Group. In addition, Airtel users will gain access to Apple Music. The spokesperson mentioned that premium users of Wink are set to receive special offers for accessing Apple Music, as Airtel has entered into an agreement with Apple to provide this service to iPhone users.

Reasons Behind the Decision

According to media reports, there are several reasons influencing this decision. The music streaming industry has become increasingly competitive with major players like Spotify, Apple Music, and Gaana posing significant challenges. Furthermore, Airtel is focusing on cost-cutting measures. Experts also opine that Airtel seeks to concentrate more on its core telecom business rather than diversifying into music streaming.

Strategic Partnership with Apple

Airtel’s Chief Marketing Officer and Executive Vice President of Customer Experience, Amit Tripathi, stated in a media report that Airtel and Apple share a “natural partnership” aimed at enhancing customer experiences. This collaboration is expected to provide customers with greater value and access to globally recognized entertainment content. By partnering with Apple, Airtel aims to elevate the level of service offered to its clients.

Market Reaction to the Decision

On a positive note, Airtel’s shares experienced a marginal rise, closing with an increase of approximately ₹9 at ₹1,522.50, according to BSE data. During the trading session, shares even reached ₹1,526, nearing the yearly high mark. For context, on June 28, Airtel’s stock soared to ₹1,539.10, marking its 52-week high. As of now, Airtel boasts a market capitalization of ₹8,66,757.22 crore, making it the largest listed company in India by market cap.

| Key Metrics | Value |

|---|---|

| Airtel’s Closing Share Price | ₹1,522.50 |

| Share Increase | ₹9 |

| 52-Week High | ₹1,539.10 |

| Market Capitalization | ₹8,66,757.22 crore |

This decision marks a significant shift in Airtel’s strategy as the company aligns its resources towards strengthening its primary telecom business amidst an evolving market landscape. With their partnership with Apple, Airtel aims to enrich its user experience, ensuring that customers continue to receive quality service amid changing offerings.