1stdibs is now 100 percent on the net. 1stdibs

The coronavirus pandemic has fueled a increase in acquiring and selling every little thing on the internet. It started with people today hoarding house necessities from Amazon and Walmart, followed by the rise of on the internet meals shipping and clothes procuring. And as lockdown dragged on, the pattern inevitably bled into luxurious, usually considered to be the previous retail frontier e-commerce has to conquer.

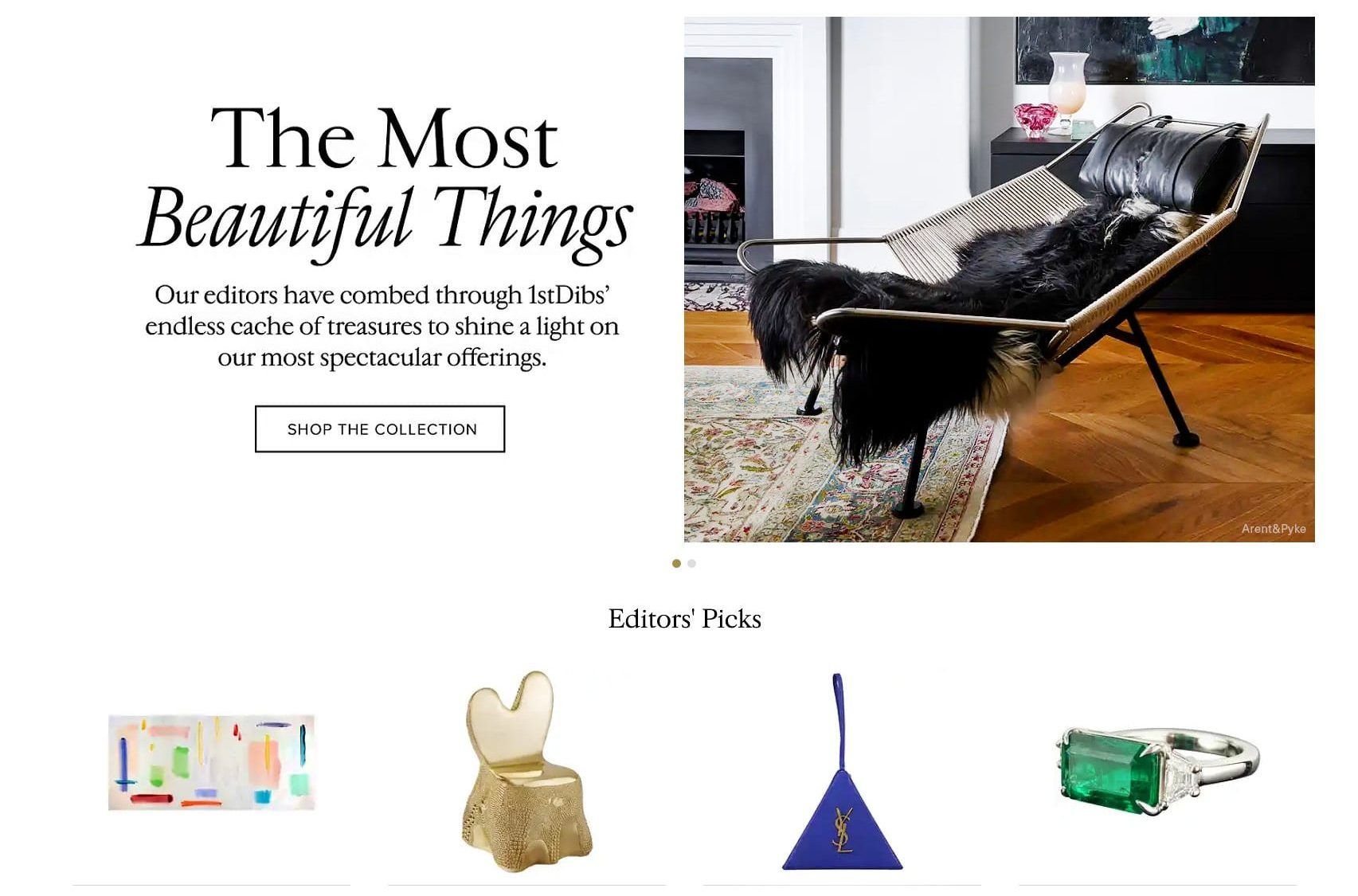

The on-line antique and collectibles market 1stdibs bet on the shift early. Started out in 2000 with the vision of bringing the magic of the Paris flea sector on line, the corporation is developed on the dangerous premise of getting an exclusive, working experience-oriented organization to the wide-open world wide web. That method has but to turn a revenue, but it undoubtedly worked wonders throughout the pandemic product sales soared as competitors’ bodily outlets shuttered, while source chains weren’t disrupted as terribly as other merchants because fifty percent of its products—vintage and antique furniture—already existed and didn’t require producing.

“COVID pulled ahead a 10 years well worth of electronic adoption. I do imagine that the change is below to stay,†1stdibs CEO David Rosenblatt instructed Observer in an interview recently.

1stdibs shut 2020 with $343 million in gross sales and $81 million in net income, a decent 15 percent bounce from the preceding 12 months.

Organization was in aspect driven by a pandemic-fueled housing growth. “There’s a large amount of pursuits in the genuine estate marketplace. When people purchase new households, they have to furnish them,†Rosenblatt stated. “That drives need for household furniture. We felt that in both of those our present-day style enterprise and the vintage and antique furniture organization.â€

Contemporary style and design home furnishings, alongside with the recently additional artwork and jewellery classes, saw the strongest need. Among March 2020 and August 2020, 1stdibs marketed 8,000 items of authentic artwork, which includes a few high priced rare finds, such as Apple from Adverts F&S II.139†by Andy Warhol and Blame Recreation by KAWS.

Previously this thirty day period, 1stdibs went public on Nasdaq and elevated much more than $115 million in refreshing funding. The company’s aim on a rather tiny, but loyal, client foundation, drew some analysts to look at it with Etsy, which went community in 2015. “It feels that the business is striving to be unique in conditions of its seller choices, far more or considerably less a area of interest player like Etsy,†described In search of Alpha in an IPO analysis last week.

“Our business products share some similarities in a feeling that we are each marketplaces for 1-of-a-kind solutions,†Rosenblatt mentioned of the comparison. “But we exist in pretty diverse sections of the industry.â€

1stdibs only has 58,000 lively buyers. But they are particularly useful ones by e-commerce criteria. In 2020, an normal person used $5,500 on the internet site. The ordinary purchase was well worth $2,500, which is 24 instances increased than the industry typical, according to IRP Commerce.

Rosenblatt declined to put a variety on unique income or earnings targets. “There’s no business that appears like us in a sense of remaining a multi-classification, totally digitally pushed luxurious market,†he reported. “The marketplace we are in is about $129 billion. COVID has catalyzed the electronic change in shopping for and marketing in this market. So, when you put all that collectively, we have a definitely prolonged runway in advance of us.â€